A Biased View of Medigap Plan G

Wiki Article

The Ultimate Guide To Largest Retirement Community In Florida

Table of ContentsFascination About Aarp Medicare Supplement Plan FAarp Medicare Supplement Plan F for DummiesThe Best Guide To Manhattan Life AssuranceThe 8-Second Trick For Plan G MedicareThe Best Guide To Boomerbenefits.com Reviews

(by mail), even if they do not also obtain Medicaid. The card is the mechanism for health care companies to bill the QMB program for the Medicare deductibles as well as co-pays.

Some Of Aarp Medicare Supplement Plan F

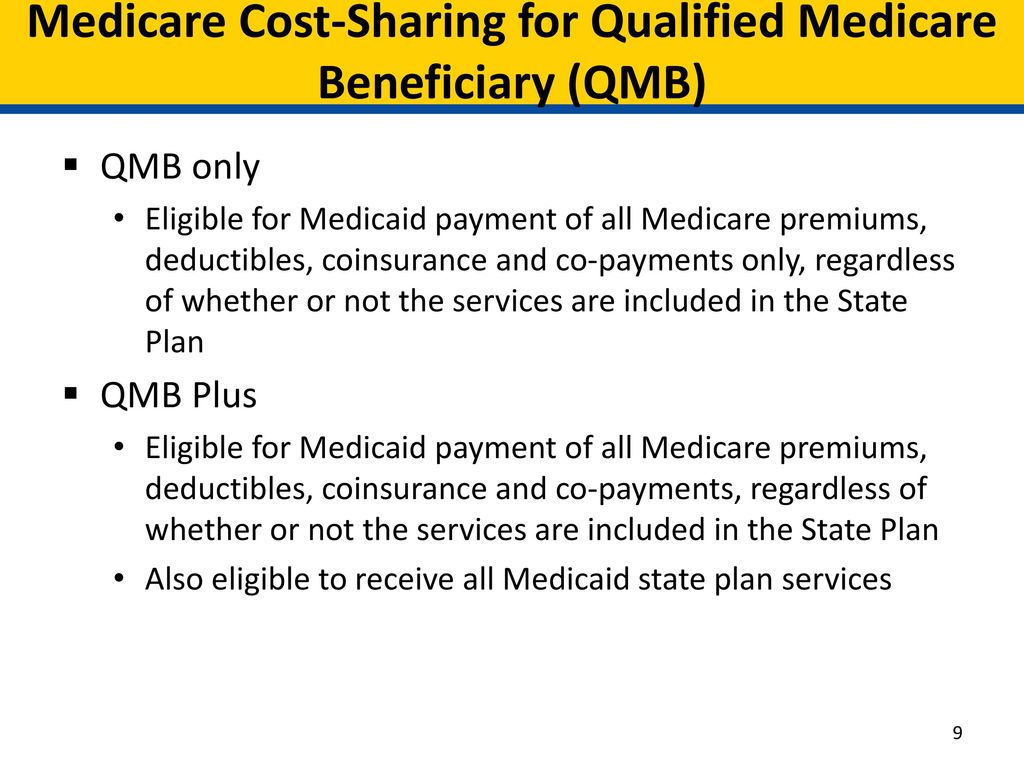

Each state's Medicaid program pays the Medicare cost-sharing for QMB program members. Any person who gets the QMB program doesn't have to pay for Medicare cost-sharing and also can not be billed by their healthcare suppliers. If an individual is taken into consideration a QMB And also, they fulfill all requirements for the QMB program however likewise fulfill all monetary requirements to receive complete Medicaid services.

The initial step in registration for the QMB program is to find out if you're qualified. You can request Medicaid to give you with an application form or situate a QMB program application from your state online.

There are instances in which states may restrict the amount they pay wellness treatment service providers for Medicare cost-sharing. Even if a state restricts the amount they'll pay a supplier, QMB members still do not need to pay Medicare carriers for their healthcare expenses and also it's versus the legislation for a supplier to ask to pay - aarp plan f coverage.

Generally, there is a costs for the strategy, however the Medicaid program will certainly pay that premium. Several individuals select this added coverage due to the fact that it supplies regular dental and vision treatment, and some come with a gym subscription.

Aarp Medicare Supplement Plan F for Beginners

Select which Medicare plans you would such as to contrast in your location. Compare prices side by side with plans & providers available in your area.He is featured in numerous publications as well as writes routinely for other skilled columns pertaining to Medicare.

Many states enable this throughout the year, however others limit when you can enlist partially A. Remember, states utilize various rules to count your revenue as well as possessions to determine if you are qualified for an MSP. Examples of revenue consist of earnings as well as Social Safety benefits you receive. Instances of properties consist of checking accounts and stocks.

And also some states do not have an asset restriction. If your revenue or properties appear to be over the MSP guidelines, you ought to still apply if you require the aid. * Certified Handicapped Working Person (QDWI) is the fourth MSP and also pays for the Medicare Part A costs. To be eligible for QDWI, you must: their website Be under age 65 Be functioning however remain to have a disabling impairment Have minimal earnings and properties And also, not currently be eligible for Medicaid.

See This Report about Boomerbenefits Com Reviews

Additional Aid covers things like: monthly premiumsdeductiblescopays for prescriptions, Some pharmacies might still charge a little copay for prescriptions that are covered under Component D. For 2021, this copay disappears than $3. 70 for a generic medication as well as $9. 20 for each and every brand-name drug that is covered. Additional Assist just uses to Medicare Component D.

MSPs, including the QMB program, are carried out with your state's Medicaid program. That means that your state will certainly identify whether or not you certify. For instance, different states might have different ways to determine your income as well as sources. Allow's analyze each of the QMB program qualification criteria in more information below.

The regular monthly earnings restriction for the QMB program enhances yearly. That implies you must still make an application for the program, even if your income increases a little. Source limits, Along with a monthly earnings limitation, there is additionally a resource limitation for the QMB program. Items that are counted toward this restriction consist of: money you have in monitoring as well as savings accountsstocksbonds, Some resources don't count toward the resource limitation.

Hearing Insurance For Seniors for Beginners

Like earnings restrictions, the resource limitations for the QMB program are different relying on whether or not you're married. For 2021, the source limitations for the QMB program are: $7,970 $11,960 Resource restrictions likewise enhance annually. Just like income limits, you need to still look for the QMB program if your sources have slightly raised.Report this wiki page